Economic fundamentals down, but West Coast inbound container business up

Container import inflow into North America keeps rising even as consumer spending slows and household debt in Canada, the U.S. and around the world keeps piling up

North America’s economic fundamentals are not looking so good, but you wouldn’t know that by digesting inbound container cargo numbers.

Household debt in the U.S. was last seen heading to US$17.3 trillion; in Canada it is closing in on $3 trillion. Global public debt, according to UNCTAD, hit US$97 trillion in 2023. Meanwhile, Canada’s economy grew by a tepid 1.7% in Q1 2024 compared with Q1 2023, while Q1 2024 consumer spending in the U.S. increased by only 2%.

And even though retail inventories in the U.S. increased by a scant 0.3% month over month in April, inbound container flows to West Coast ports keep on rising.

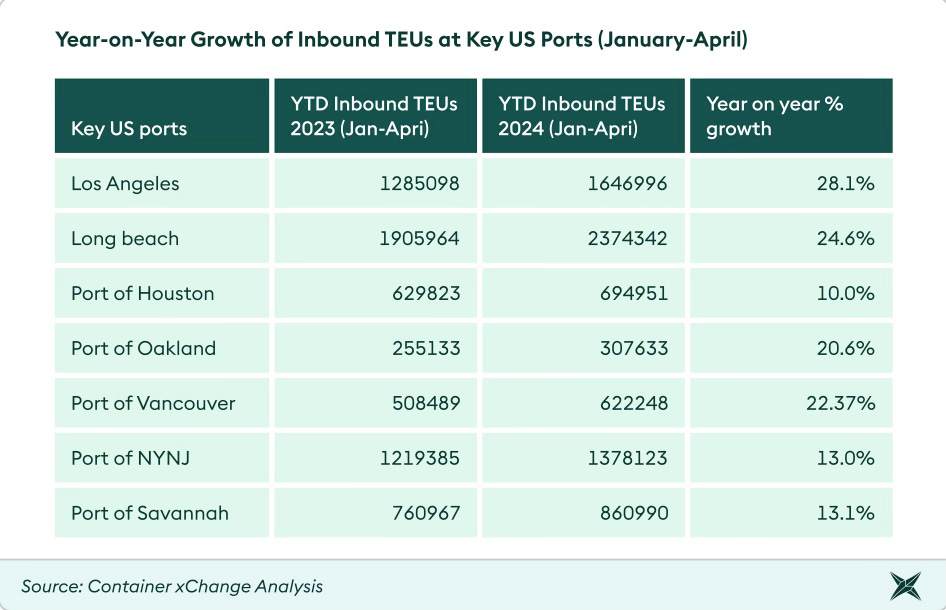

As noted in June’s container market update from logistics technology company Container xChange, Q1 2024 year-on-year inbound TEU increases ranged from 22.4% (Port of Vancouver) to 28% (Port of Los Angeles).

The numbers echo results in the most recent data compiled by container shipping analyst John McCown, who noted that April was the third consecutive month of double-digit inbound container increases at the top 10 U.S. ports.

The good news for shippers here is that North America’s weak economic fundamentals should start deflating a container price bubble that included what @Container xChange noted was a 45% price jump in China in May compared with April. That increase pushed the cost of a 40-foot container to US$3,250 in May. The same container was around US$1,698 in November 2023.

A container capacity deficit, driven by Red Sea diversions, and a demand bump from buyers hedging bets against future supply chain disruptions are, according to Container xChange, the main container price inflation factors.

But company CEO @Christian Roeloffs predicted that the container bubble is set to burst.

“As the initial rush to restock inventories subsides and the real demand from consumers and businesses remains flat, we anticipate a stabilization or even a decline in container prices in the mid-term. The market is showing signs of volatility driven by short-term factors, rather than a sustained increase in demand.”

Canada’s ports face other volatility factors on their horizon.

The latest unionized membership in line to disrupt the Asia-Pacific Gateway is the Public Service Alliance of Canada’s (#PSAC) Border Services group, which armed its PSAC contract negotiating committee with a strike vote on May 24.

PSAC joins the union strike-vote conga line led by the International Longshore and Warehouse Union Ship & Dock Foremen Local 514 and the #Teamsters Canada Rail Conference. Any member of that trio could shut down all but essential cargo movement through Canada’s Asia-Pacific Gateway.

Container prices will then be far down the priority list for shippers who rely on a fully functioning supply chain in Canada.

www.linkedin.com/in/timothyrenshaw

@trenshaw24.bsky.social

@timothyrenshaw