Global energy investment targets transportation, clean tech in 2025

International Energy Agency forecasts that trillions of dollars will be funnelled into electrification and renewables this year

Transportation electrification investment update 2025: Momentum building, but inflation, politics and other road hazards ahead on Electric Avenue.

Hazard alerts and other road trip details are outlined in the International Energy Agency’s (IEA) World Energy Investment 2025 (WEI 2025) report, but transportation electrification is only one part of its energy investment analysis.

We have, for example, what the IEA estimates is a record US$3.3 trillion being invested in global energy this year. That’s a 2% increase over 2024.

The good news for the environment is that renewables, nuclear, low-emission fuels, electrification and other clean technologies are set to secure a record US$2.2 trillion. Investment in oil, natural gas and coal, meanwhile, is on pace to hit US$1.1 trillion.

According to WEI 2025, the renewables investment surge reflects “not only efforts to reduce emissions but also the growing influence of industrial policy, energy security concerns and the cost competitiveness of electricity-based solutions.”

“The main driver of [global transportation investment] growth is the electrification of transport”

– International Energy Agency’s World Energy Investment 2025

China is now the world’s biggest energy investor.

Its energy investment portfolio is twice that of the European Union’s, according to IEA data, and almost equal to the combined EU-U.S.A. investment.

Committed to cutting its imported oil dependence, China now accounts for approximately one-third of all global clean energy investment.

On the darker side of China’s energy investment portfolio, the country continues to invest heavily in coal and coal-powered energy. Together with India, it was responsible for almost all of 2024’s new investment in coal.

The IEA estimates that coal investment will increase by another 4% in 2025 and hit a record high this year. Its most recent OECD electricity data shows Q1 2025 coal-generated electricity up 8% year on year.

But back to transportation’s electrification road trip.

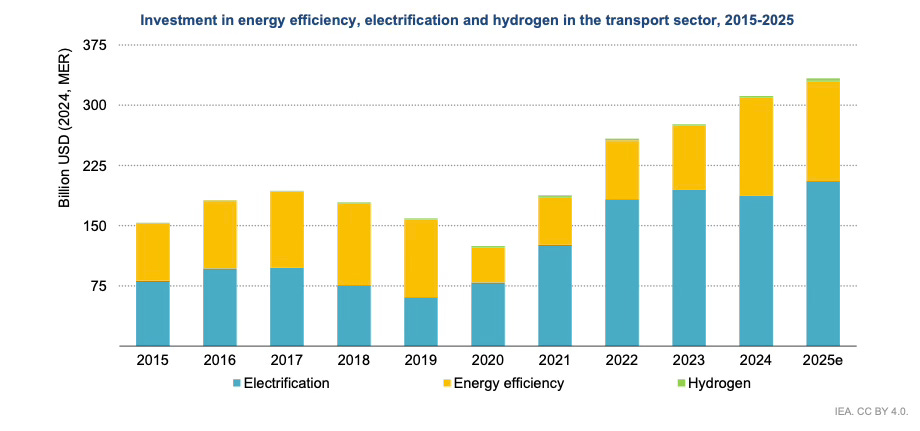

According to WEI 2025, the annual investment in electric vehicles and efficiency improvements in internal combustion engines has quintupled since 2015 and is poised to reach US$220 billion this year.

As noted in a previous Substack Shipping News report, more than 17 million EVs were sold worldwide in 2024. That, according to the IEA, has increased EV market share to 20% [more than one in five vehicle sales] compared with just 1% in 2015.

Two-thirds of 2024’s EV sales were in China, where sales of electric vehicles now account for 50% of the country’s domestic vehicle sales.

Europe and North America remain in China’s distant rear-view mirror in the EV adoption sweepstakes. According to WEI 2025, their shares of global EV sales are 18% and 11%, respectively.

That is not surprising, considering how thoroughly China has outflanked the West in EV production, technology and price range.

But the current anti-electrification administration in the United States is also doing its best to increase China’s EV advantage.

Overturning California’s plan to prohibit the sale of new gas-powered cars in the state by 2035 is the federal government’s latest anti-EV initiative.

Still, as the IEA report notes, 1.6 million EVs were sold in the United States in 2024. That accounted for 10% of total car sales. It was also triple the number sold in 2021 and followed annual EV sales increases of 56% in 2022 and 42% in 2023.

EV sales in Canada jumped 138% in 2022 compared with 2021 and 58% in 2023 compared with 2022.

However, sales dropped 16% in 2024 compared with 2023 and accounted for approximately 16% of light-duty vehicle sales in the country.

Higher interest rates, bleaker economic outlooks, the scarcity of lower-priced EV models and the elimination of government incentives are among the EV adoption deterrents in North America.

However, the energy investment bottom line, as WEI 2025 details, is electrification acceleration.

It notes that global transportation investment has more than doubled in the past decade and is projected to exceed US$330 billion in 2025.

“The main driver of this growth is the electrification of transport,” WEI 2025 notes, “particularly EVs, which account for around US$175 billion, followed by rail electrification at almost US$35 billion.”

The report adds that electrification is the target of approximately 60% of all energy investment globally.

The EV market tipping point is on the horizon. Battery storage technology, the availability of recharging infrastructure, and the proliferation of environmental benefits will determine the mileage left to cover.

www.linkedin.com/in/timothyrenshaw

@trenshaw24.bsky.social

@timothyrenshaw