Global trade organizations forecast more bad economic weather for North America

Reports from the World Trade Organization and UN Trade and Development downgrade outlooks for what could have been a fiscally buoyant year in the West

If you’re looking for updated body-count estimates from the U.S. war on trade, the World Trade Organization’s (WTO) most recent trade outlook is a good place to start.

The April 2025 Global Trade Outlook and Statistics report from the organization that oversees global trade rules provides a major reset of forecasts in the wake of the blunderbuss tariff regime loosed on the world April 2 by the Donald Trump administration.

Were it a 2025 weather update, unsettled conditions on the horizon would be an understatement.

Storm warnings for business and consumer communities across North America would be more accurate.

Dark clouds and bad weather forecasts in other parts of the world, too.

Here’s the intro script from your WTO trade meteorologist: “The outlook for global trade has deteriorated sharply due to a surge in tariffs and trade policy uncertainty (TPU) …”

Not a lot of sunshine there, and the forecast does not get much brighter.

It notes, for example, that global trade in 2025 and 2026 was expected to be as buoyant as it was in 2024, which was a bounceback year from 2023, primarily because of lower inflation and improved macroeconomic conditions. Inflation in G20 countries in 2025 was on track to be half of what it was in 2023, dropping to 3.3% from 6.1%. Wage increases were in the cards in North America and Asia.

The business climate in pre-trade war 2025 was also relatively cloud-free.

Global container cargo throughput in the first two months, according to the WTO, was up 5.3% compared with the same two months in 2024. Throughput at northern European ports was up 10.8%.

Warning signs for North America were already on the horizon, however. Data collected by New York-based container shipping analyst John McCown showed February’s year-over-year growth in imports flowing through the top 10 U.S. container ports dropping to 3.4%. That was down from January’s (13.7%) and December’s (14.2%) year-over-year increases.

But global goods trade is now set to contract rather than expand. The WTO sees a -0.2% drop in that trade for 2025.

Global transport volume is consequently projected to grow at a meagre 0.5% compared with what had been expected to be 2.9%.

Trade policy uncertainty is at a historical high, and this is already translating into delayed investment decisions and reduced hiring

– UNCTAD’s Trade and Development Foresights 2025 report

That will weaken freight rates for global container shipping companies that are already facing capacity surpluses as a record number of new ships are being added to the global container fleet.

The WTO is not alone in its bleak economic weather forecast for 2025.

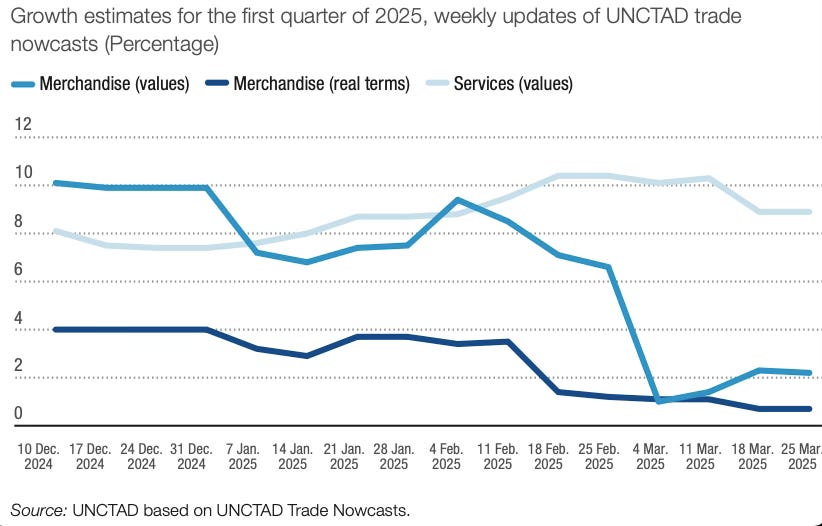

UN Trade and Development (UNCTAD) is warning that escalating trade tensions and persistent uncertainty are driving the world economy into a recession.

It notes that, despite 2024’s stronger-than-expected economic growth performance of 2.8%, 2025 is now on pace for a tepid 2.3% growth, which is below the 2.5% threshold marker of a global recession.

“Trade policy uncertainty is at a historical high,” UNCTAD’s Trade and Development Foresights 2025 report notes, “and this is already translating into delayed investment decisions and reduced hiring.”

So, best to get out and enjoy that sunny spring economic weather while you can.

www.linkedin.com/in/timothyrenshaw

@trenshaw24.bsky.social

@timothyrenshaw